Enable’s recap our fool-evidence guideline to unlocking a loan around $a thousand while expanding your credit rating score!

Signal Your Deal: Choose the loan that works finest for you personally and read in the arrangement. Be sure to recognize when payments are thanks and what costs you may perhaps should spend.

Loans for credit rating scores underneath 600 is usually high-priced and a bit challenging to qualify for. Your rate is going to be significant, and you could possibly pay back origination costs. Moreover, you could have to offer the lender with loads of documentation such as evidence of earnings and work, proof of identification, evidence of address, and a listing of your property and liabilities.

This can be a effective marriage for that retailer and lender, even though also supplying The patron Added benefits too. In the event you’re a service provider, Acorn Finance can operate with you to provide embedded lending for purchasers.

If you employ retailer financing, you may only have the ability to apply the cash towards your obtain. If you employ a charge card, you must generate a invest in from a service provider that accepts the charge card. Starting off to be aware of the sample? Identifying what you will need the loan for can assist you select the most appropriate loan possibility.

It is dependent upon irrespective of whether your loan software is authorized ahead of the lender’s similar-working day cutoff. Lots of direct lenders and cash advance applications offer same-day or following-day funding, allowing you to acquire cash swiftly.

If you make an application for a $600 loan at Progress The us, there’s no effects for your FICO credit rating score. Based on the lender you end up picking, a $600 loan might have an impact on your credit history, especially if you fail to repay the loan punctually.

Desire is calculated around the Original principal, which also contains more info most of the amassed curiosity from previous intervals with a deposit or loan.

While you might borrow much more than you may need, a private loan may be a lot more affordable. As normally, it’s essential to weigh your choices. With aggressive presents at your fingertips you can store delivers and come across just the correct a single.

Credit unions normally have additional lenient own loan acceptance needs than banks, and should be inclined to contemplate applicants with poor credit history. You could find credit rating unions in your town on WalletHub and seek the advice of with them to see When you've got a shot at acceptance.

For example, if you know that your monthly payment will instantly be withdrawn out of your checking account, it’s vital to have sufficient money and prepare for that transaction.

Lenders might want proof in the form of receipts or perhaps a confirmation letter with the creditor that payments are up-to-date, or any arrears are already compensated. This demonstrates the borrower has built an energy to pay their costs despite possessing tough circumstances.

Some lenders could want you to have a co-signer, or They could ask for collateral to protected the loan. If you're able to elevate your credit score rating, you will stay away from A lot of this.

Matt Mayerle is often a Chicago-based Material Manager and writer centered on own finance matters like budgeting, credit history, and also the subprime loan sector.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Michael Bower Then & Now!

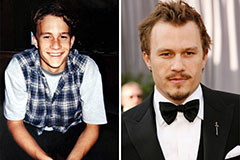

Michael Bower Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!